At ARA we do Personal Financial Planning.

Face to Face.

We provide personal financial advice and guidance, free of the shackles of corporate ownership. Our process, our products and our plans are all set up to allow us to remain that way.

This includes all the usual stuff like Superannuation, Investment Management, Tax and Centrelink. But, most importantly, it involves developing a deep understanding of the person and their own unique needs – how they want to live in retirement, how they’re going to put their kids through school, how they want their families cared for…

Because it’s not about money, it’s about people.

We also strive to conduct ourselves and our business in a way that reflects the highest standards of personal and corporate behaviour. This extends to our broader social and community responsibilities. To read more, please visit the ARA in the Community page.

The process goes like this...

Step 1

Get to know you

We have an initial meeting at which we learn about each other. Of course we look at assets, liabilities, income, etc., but critically we must understand what is important to you.

That first meeting is free of charge and obligation. The simple aim is to establish whether we can help, and whether we are right for you.

If the answer is no, we part friends. If the answer is yes…

Step 2

Develop a plan

…we will gather full detailed information and prepare you a set of recommendations. We then meet again to discuss these personally. We quote you a fee upfront before you commit to anything. The resulting plan is yours to keep without obligation.

Step 3

Ongoing management

If there are any ongoing services that form part of the plan, such as portfolio management, insurances, superannuation, Centrelink, again, the cost of those services will be quoted in advance prior to any commitment on your behalf.

This could be the start of a beautiful friendship…

What are you looking for?

Let us help you find information useful to your situation by taking this short five question quiz.

Subscribe to our News Desk

Stay up-to-date with news and views on the world of finance

Access important guides to help plan your financial future

Important: We won’t ever sell your email details. We will only communicate with you when we have something important to say.

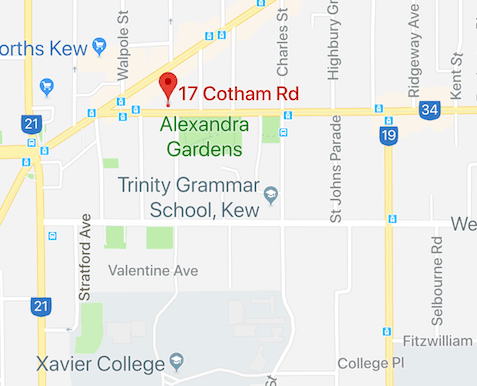

Get in touch

If you like what you see contact us for a no obligation chat to discuss how we can help you.