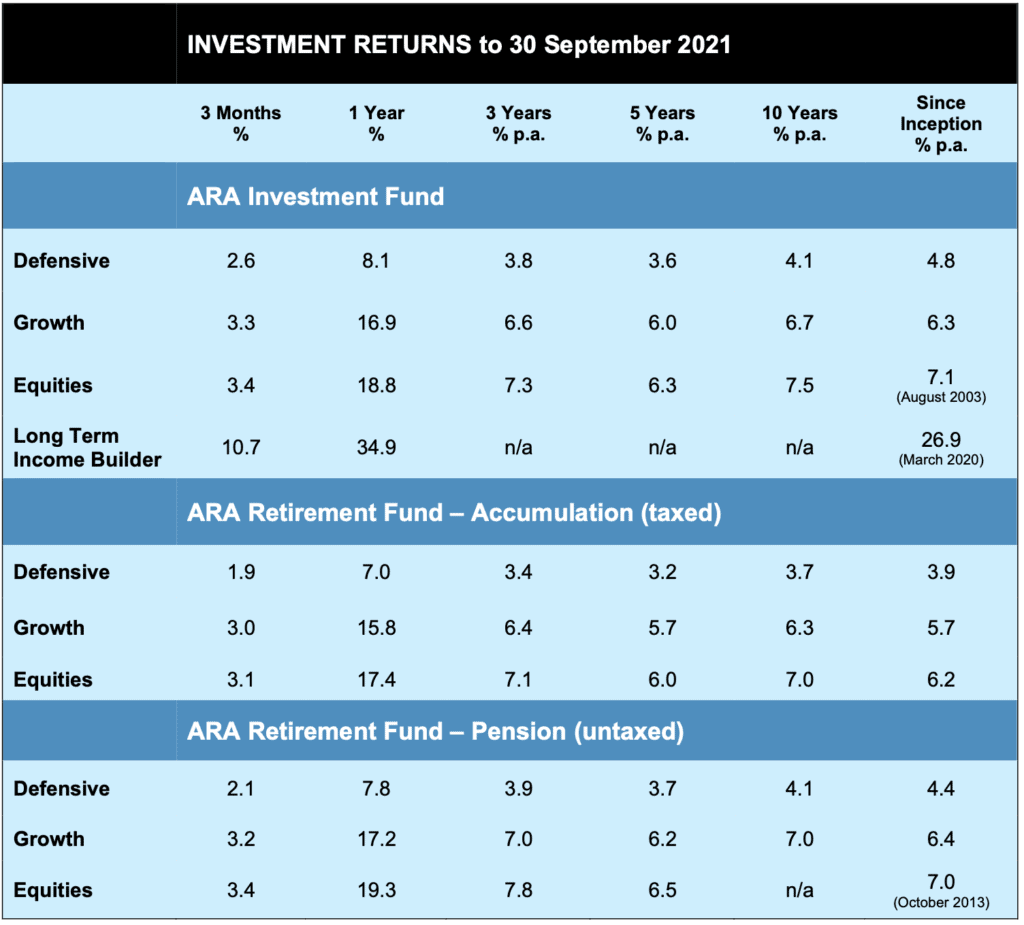

Markets held up reasonably well for the quarter, if a bit wobbly towards the close, with the juggernaut US stock market barely in the black by September 30. Nonetheless we are able to report another sound quarter’s results, thanks largely to some strong results from a number of our private company investments.

The highlight was the successful listing and exit from our holding in Cobram Estate Olives which, over its 11-year tenure in the Fund, returned over seven times our outlay, including a 25% uplift over the last quarter as the exit process unfolded. Good oil indeed!

In the light of stock markets that look increasingly stretched, this quarter marked a couple of important tipping points which have triggered some significant tweaks to our investment strategy. In short, we’re taking some profits, and going more defensive in our stance.

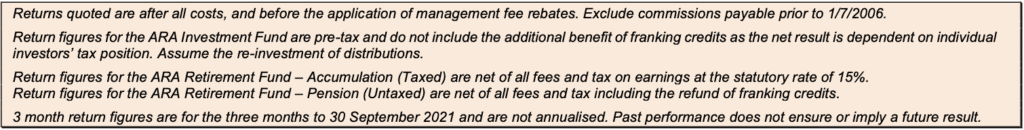

Let’s begin with a look at the Fridge Chart. During the quarter it looked like this:

At these levels:

The US market is well into Overpriced territory. Not only that, at anything above about 4,400 points, its forecast 5-10 year return is actually negative;

The Aussie market is borderline fully priced. Arguably still reasonable value, but note that the forecast return is of the order of 4-4.5% p.a.. Maybe that’s also achievable in something that carries less risk than shares.

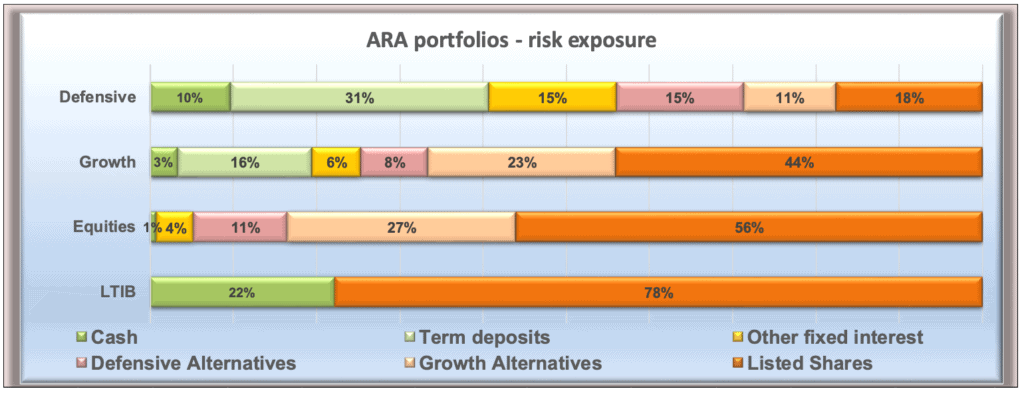

As a result, we have implemented the following steps:

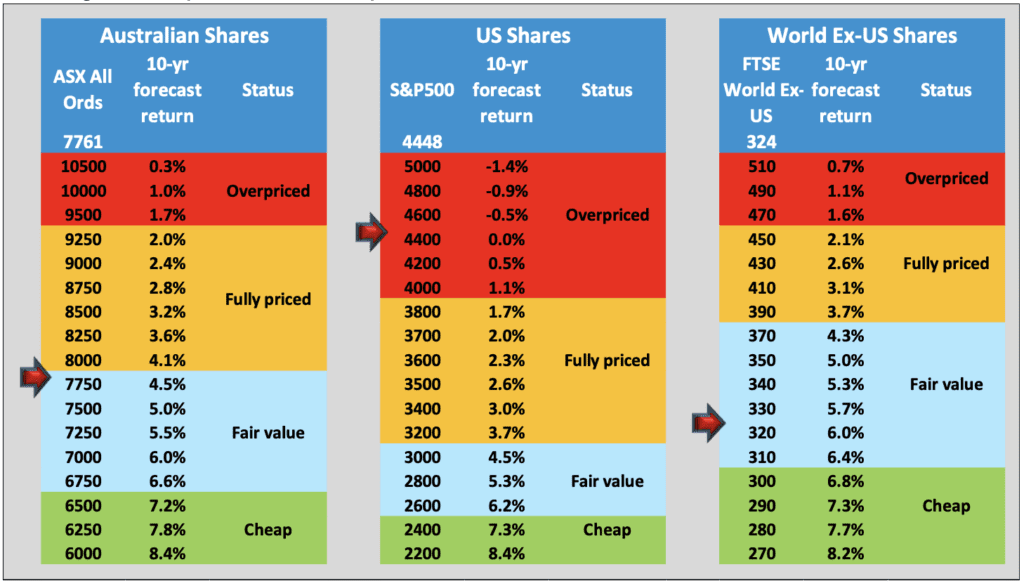

- Reduced exposure to listed shares, both Australian and International, as shown in this table:

We may do more in due course, depending how things progress. We have to be mindful of the costs of transactions and tax that usually come with re-balancing, so like a lot of things in this business there is a trade-off to manage.

- Increased exposure to “Alternative” investments, in particular Defensive Alternatives.

“Alternatives” is a fine piece of industry jargon that, while quite broad and not necessarily crystal clear in definition, basically refers to anything that is not one of the “traditional” asset classes – shares, interest-bearing deposits/bonds or property.

This can include:

Defensive investments like corporate debt, mortgages and hedge funds that are risk- averse

Growth investments with a higher risk profile, such as private equity, with which we are now very familiar, structured products that use leverage and other tricky bits to chase higher returns, and hedge funds with more aggressive intent.

In principle at least, their common characteristic is that they aim to behave in a fashion that is different from traditional markets, and thereby offer diversification benefits and reduce volatility. Our table of holdings later in this report shows what we now own in each category, and we will take a deeper dive into some of these investments in future sessions.

- Actively hedging against the US market.

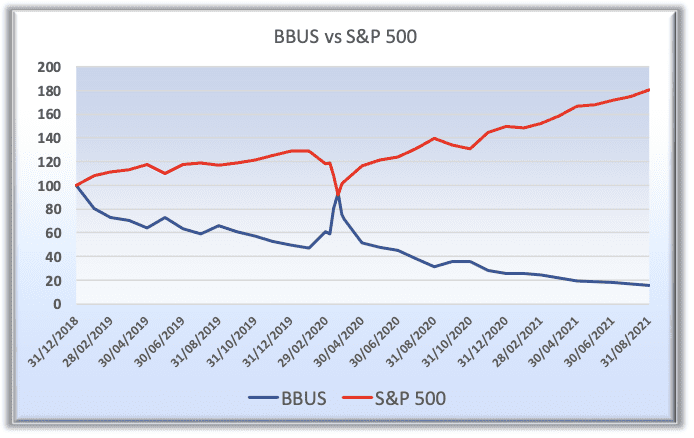

Something we’ve thought about for a long time and now begun. We have bought into a fund specifically designed to do the opposite to the US market. It works too – here’s its history (in blue) since the end of 2019 compared with the US S&P 500 index (red).

So this will provide a positive return if the US market falls – and vice versa if the US continues its relentless rise. From these levels we hope the probabilities are on our side, but clearly this is a strategy that needs a close watch.

None of this is intended to suggest that you need to think about re-weighting your own portfolio mix – rather, that we are doing it for you behind the scenes. But of course feel free to discuss your own situation and preferences with your ARA planner.

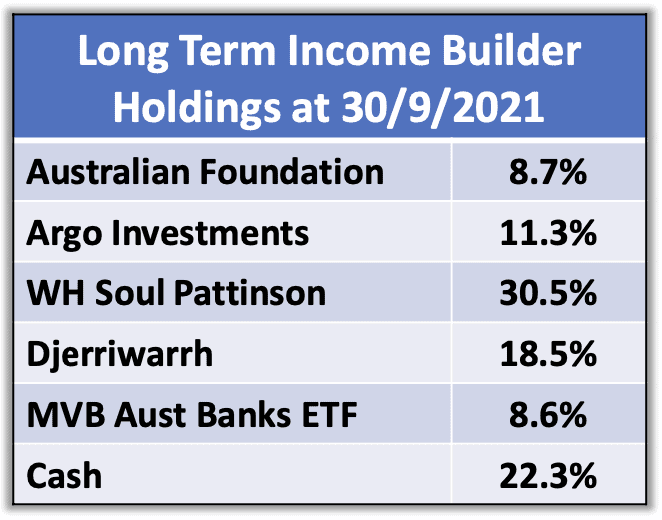

Long Term Income Builder

I don’t want to put the mozz on it, but our new portfolio continues its strong performance.

This quarter saw further benefit from the merger of our largest holding, Milton Corporation, with WH Soul Pattinson, which saw a strong uplift in valuation as well as the prospect of forthcoming special dividends.

A reminder that this portfolio is mainly about the steady, rising dividend income and less about market prices which, as we know, can and do fluctuate. While we happily accept the strong valuation uplift it has enjoyed to date, that is not expected to be the longer term norm. Dividends tend to hold the line regardless of price fluctuations.

Currently the portfolio holds a core of large listed investment companies, plus additional exposure to the banking sector via a satellite ETF.

It’s temporarily cashed-up awaiting deployment into a couple of interesting opportunities for this portfolio. We expect these to settle early in this next quarter and will provide more detail in future sessions.

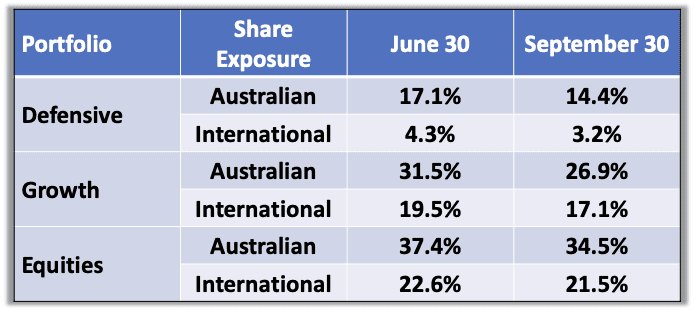

So, who’s got what?

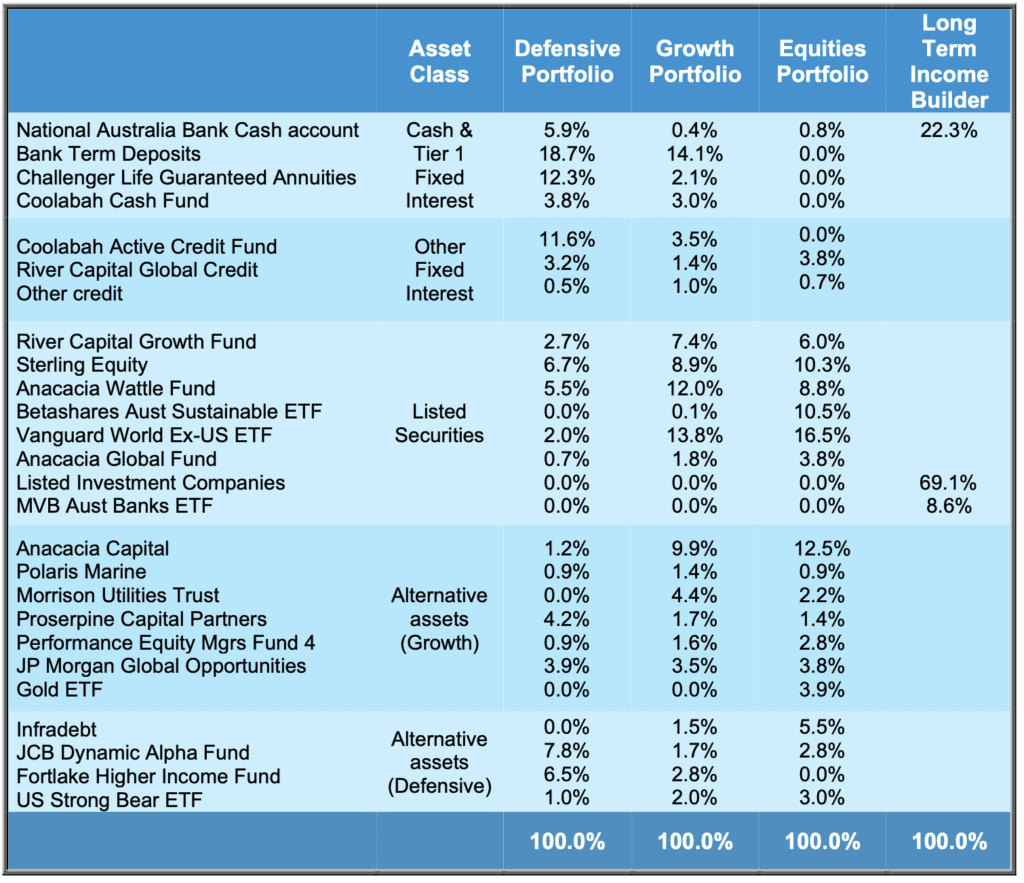

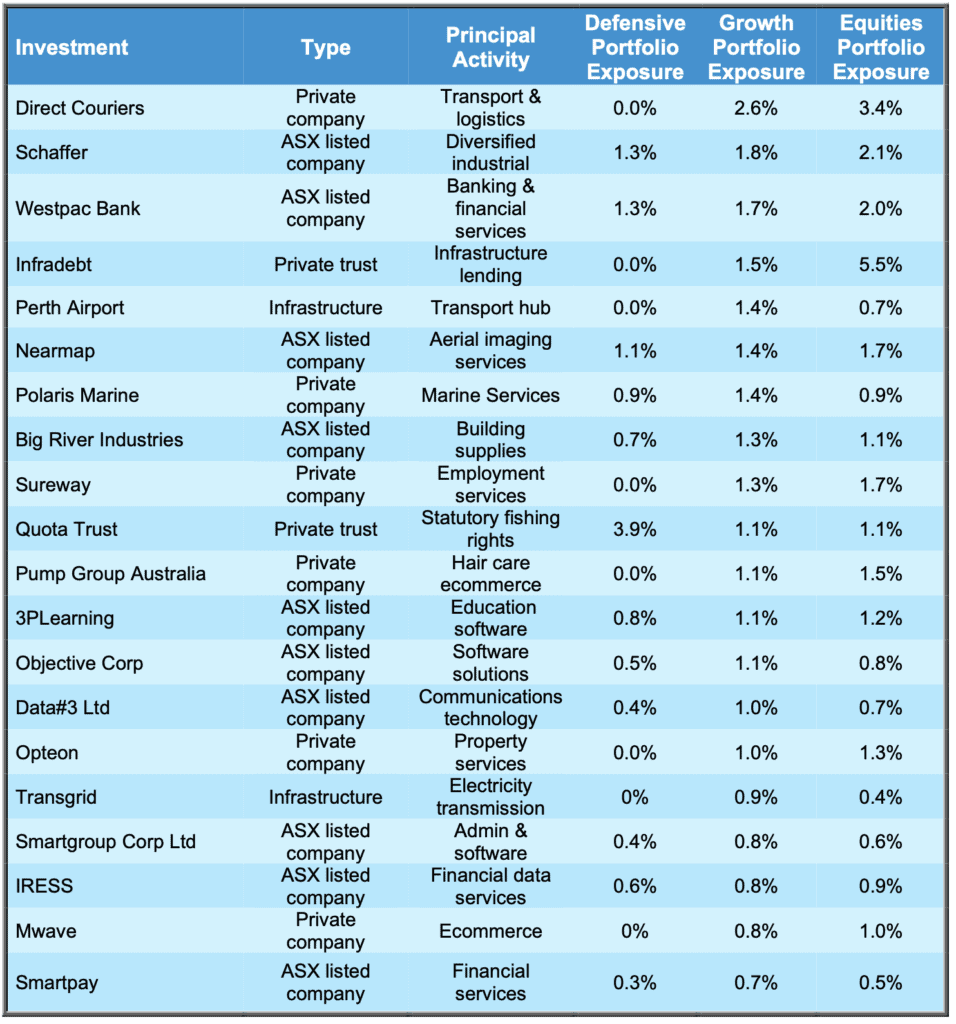

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. You should also refer to the relevant Target Market Determination (TMD) for the product. The PDS and applicable TMDs are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: October 2021 Investment Update.