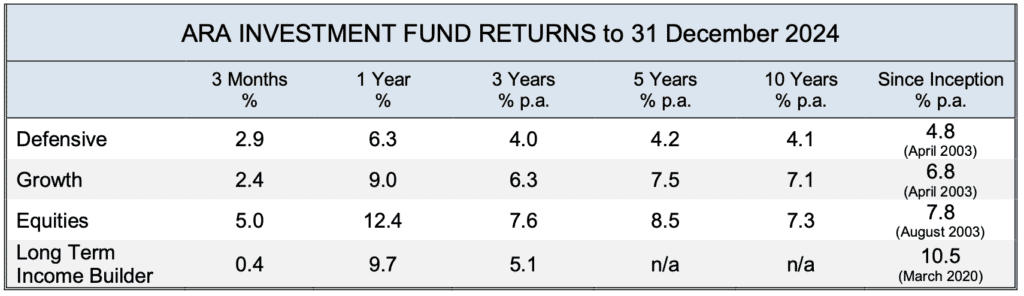

An interesting quarter, pretty much all good news for our investors.

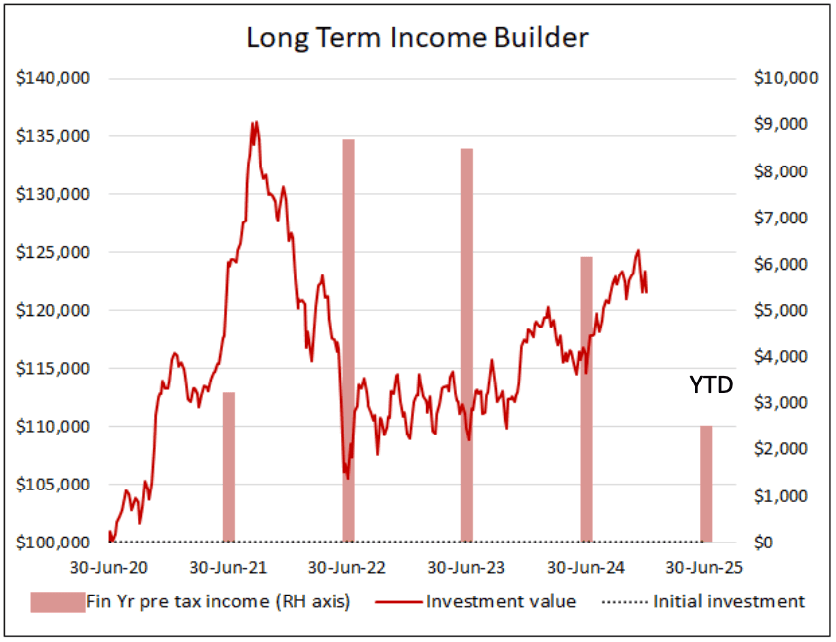

Let’s start with the Long Term Income Builder. While 0.4% might not get the old heart racing, it’s solid enough given the stock market at large was down by 1%. But as we’ll say (yet) again, this portfolio is about stable, rising income over time – and if income grows the underlying value will look after itself, short term price shifts notwithstanding.

The chart below shows the growth (or otherwise) in dividends paid by the four core holdings in the LTIB portfolio over the past five calendar years. We have previously described how dividends were subdued in the aftermath of the pandemic lockdowns, but were expected to recover and resume their long term growth pattern. This seems to bear that out, and we see no reason why it should not continue, and be reflected in the distributions from LTIB in due course.

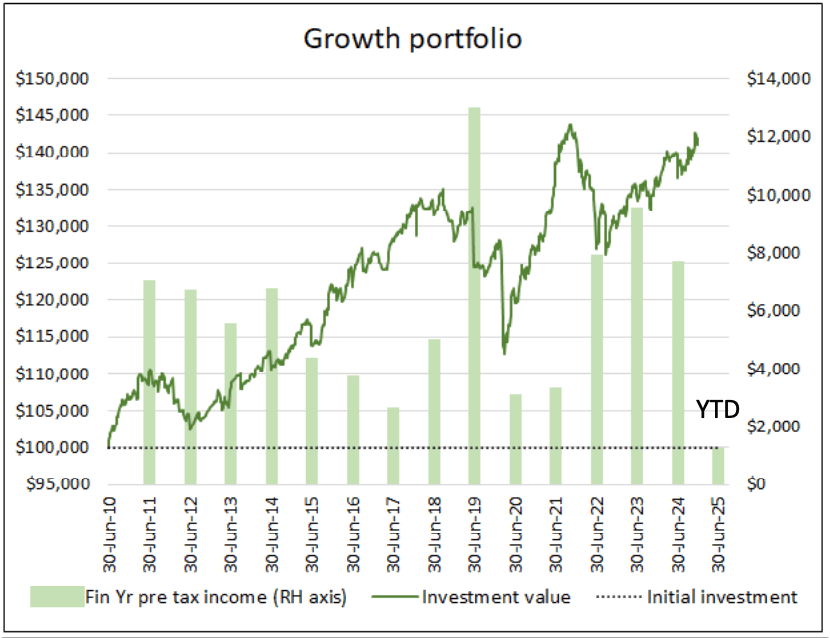

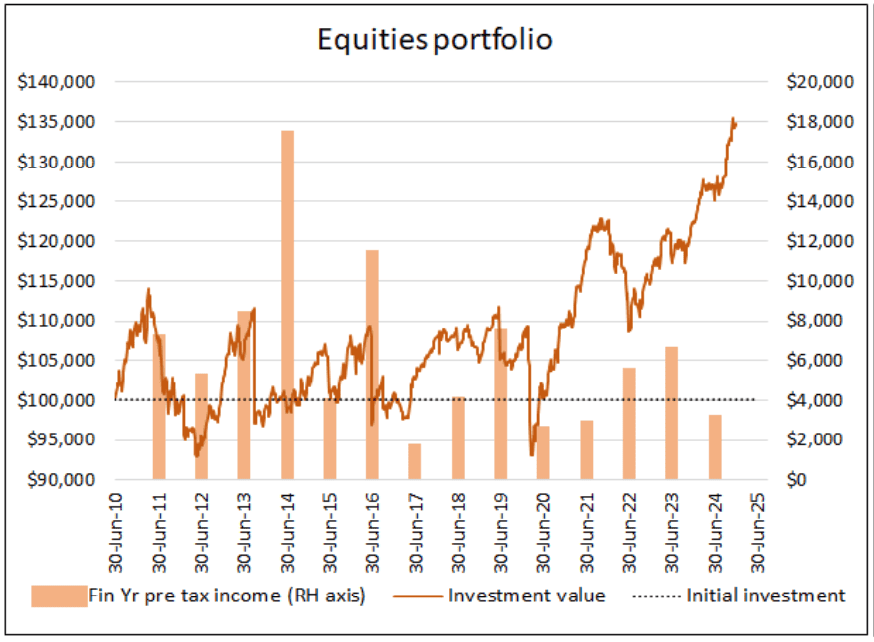

Which brings us to the three diversified portfolios, and an interesting conundrum. Nice numbers, and we’ll happily take that. But if there is a concern, it’s actually that they are outsize returns – more than you’d normally expect, particularly for Defensive. So you have to ask – how did this happen? Too good to be true? And does it really mean there is more risk involved than there should be?

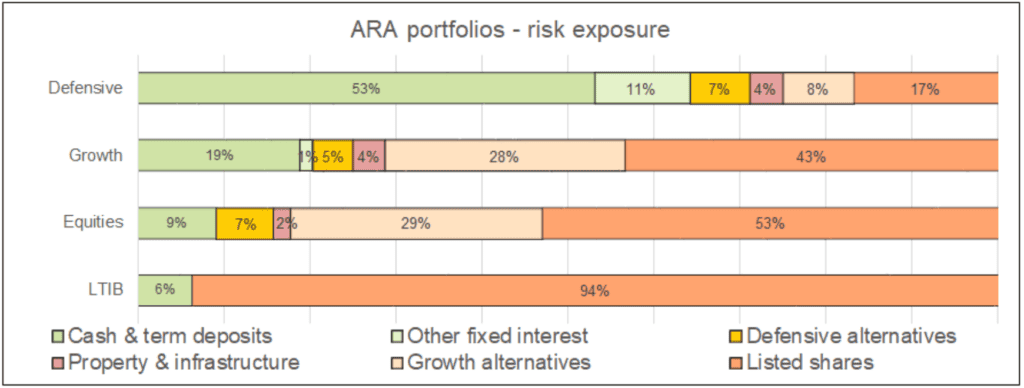

Well, firstly, the Risk-o-Meter below is not flashing any warnings. Listed and unlisted shares in Defensive total less than 25% of the portfolio – pretty much where it’s been for some years now. Consequently, holdings of nice safe things like cash and fixed interest levels are also well up where they should be.

There were some strong performers for sure, and importantly, no major disasters. As it happens, the unusual outlier over the last three months was the Aussie Dollar, which fell against major currencies, notably about 10% against the $US. While we don’t invest directly in currencies per se, this big swing turbocharged anything that has unhedged exposure to offshore assets – including Anacacia’s Global Fund, Dimensional’s International portfolio, PEM’s private equity fund, and a few other bits and pieces throughout the portfolios.

10% is a big move in a short space of time. It could have further to go, or it could all unwind and claw back some of the kicker we’ve enjoyed. The answer will be somewhere in the middle. But for now – Happy New Year!

Speaking of which – what might 2025 hold? Well, the big talking point from the quarter is confirmation of a second Trump presidency. The conventional wisdom says a Republican president, particularly one so brashly pro-business, is good for share markets. Maybe, but:

- Which, if any, of the bold promises will really be acted upon?

- US shares already looked expensive, then surged on the prospect of the Trump win before sobering up a bit. It could be that more than enough optimism is priced in already;

- The US’s annual interest bill – not the debt, the interest payable yearly – now exceeds $1 trillion! With a “T”! That’s three times what it was just five years ago. Haven’t heard much on the debt front lately, but that’s gotta hurt.

It might not be such a Grand Old Party. Time will tell.

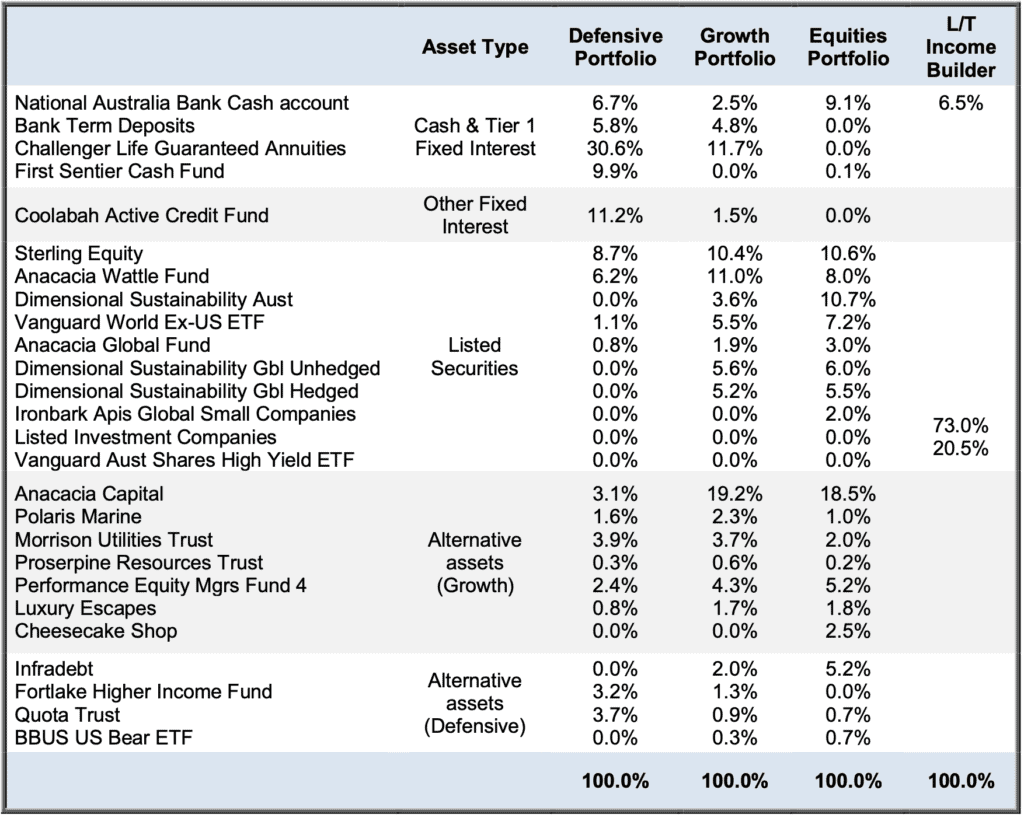

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

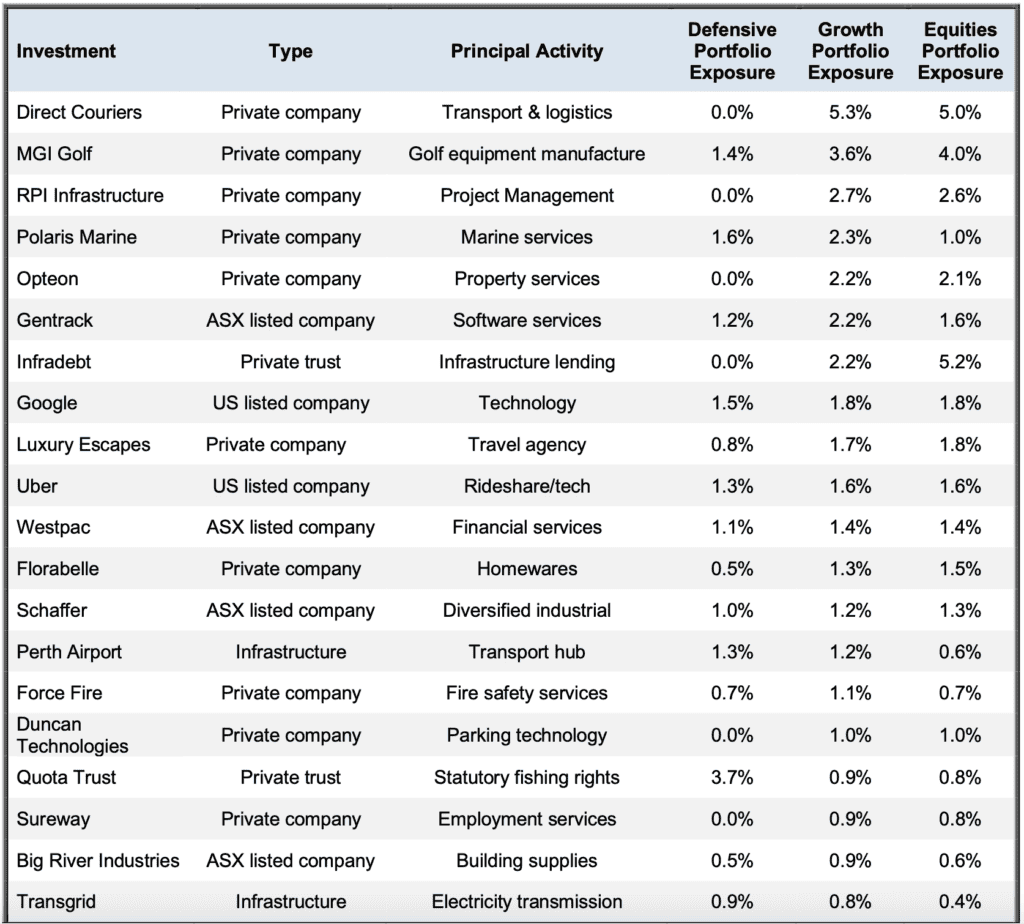

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

Returns quoted in this report are after all costs, and before the application of management fee rebates. Return figures are pre-tax, and include the value of franking credits from franked dividends. Total return figures assume the re-investment of gross distributions including franking credits. 3-month return figures are for the period to 31 December 2024 and are not annualized.

ARA Consultants Limited provides this update for the information of its clients and associates. If you do not wish to receive this or other information about ARA in future, please contact us on (03) 9853 1688.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. The PDS and applicable Target Market Determinations are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved previously does not guarantee or imply that they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: December 2024 Quarter Investment Update.