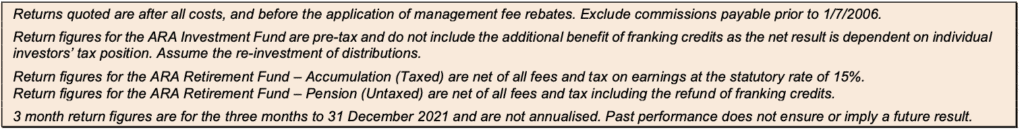

Quarterly results were somewhat subdued, but keeping a sense of perspective it’s unrealistic to think that recent results could be maintained indefinitely. We were probably due for a breather.

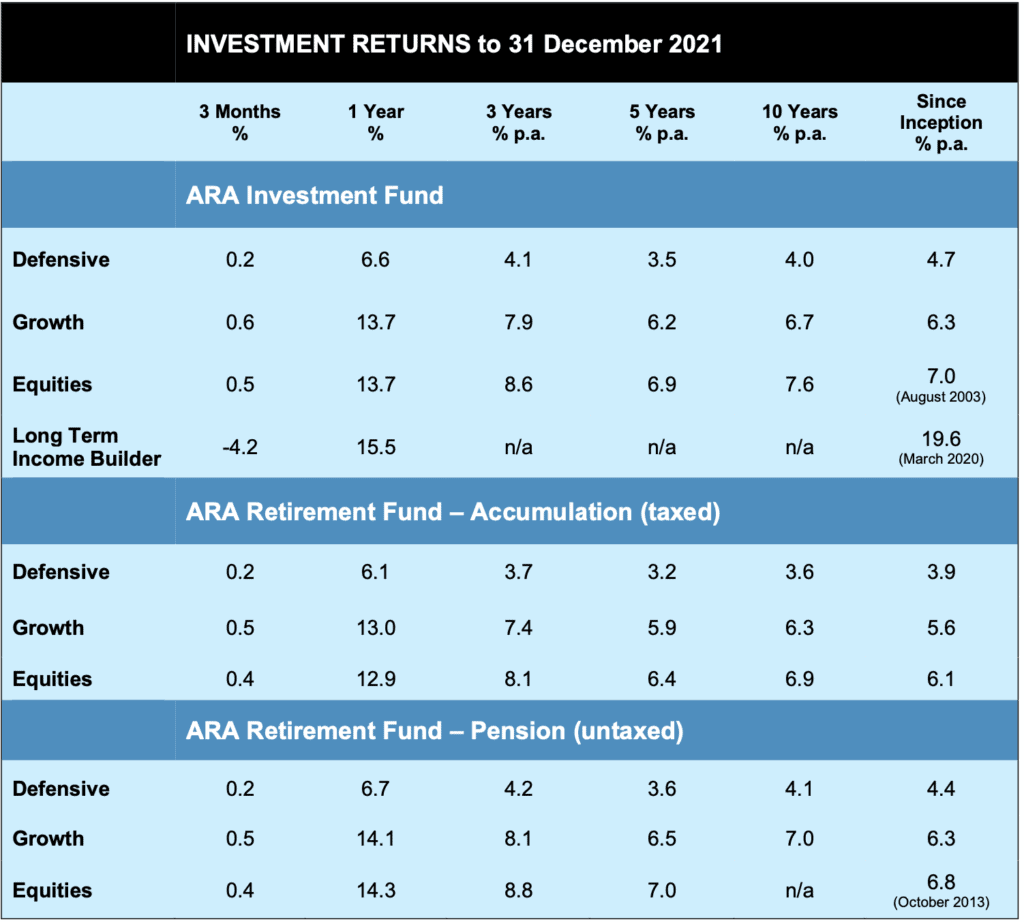

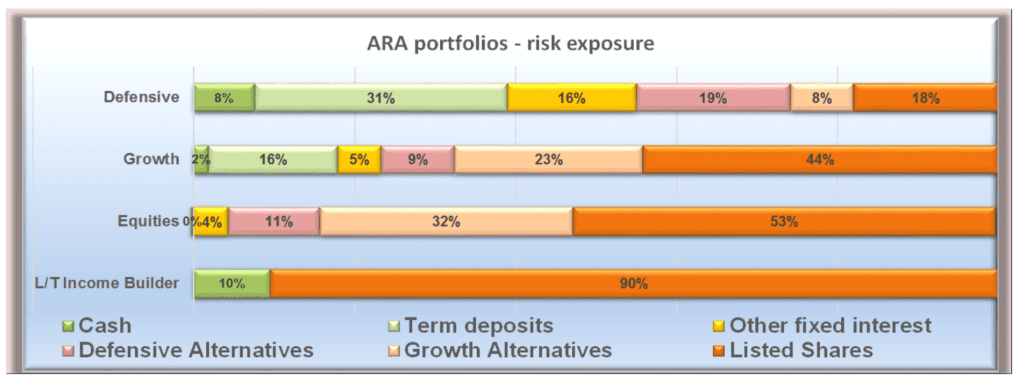

Longer term, all portfolios are tracking well ahead of their respective targets:

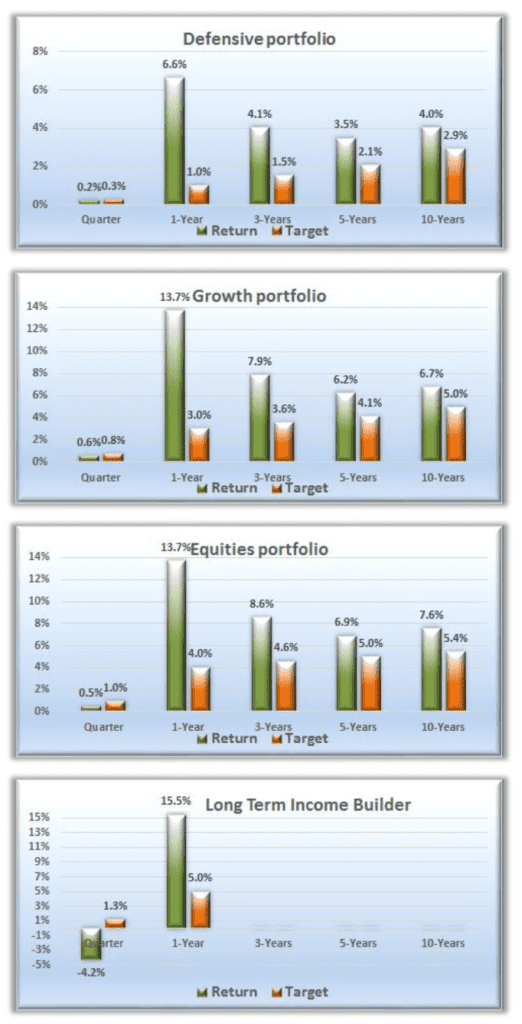

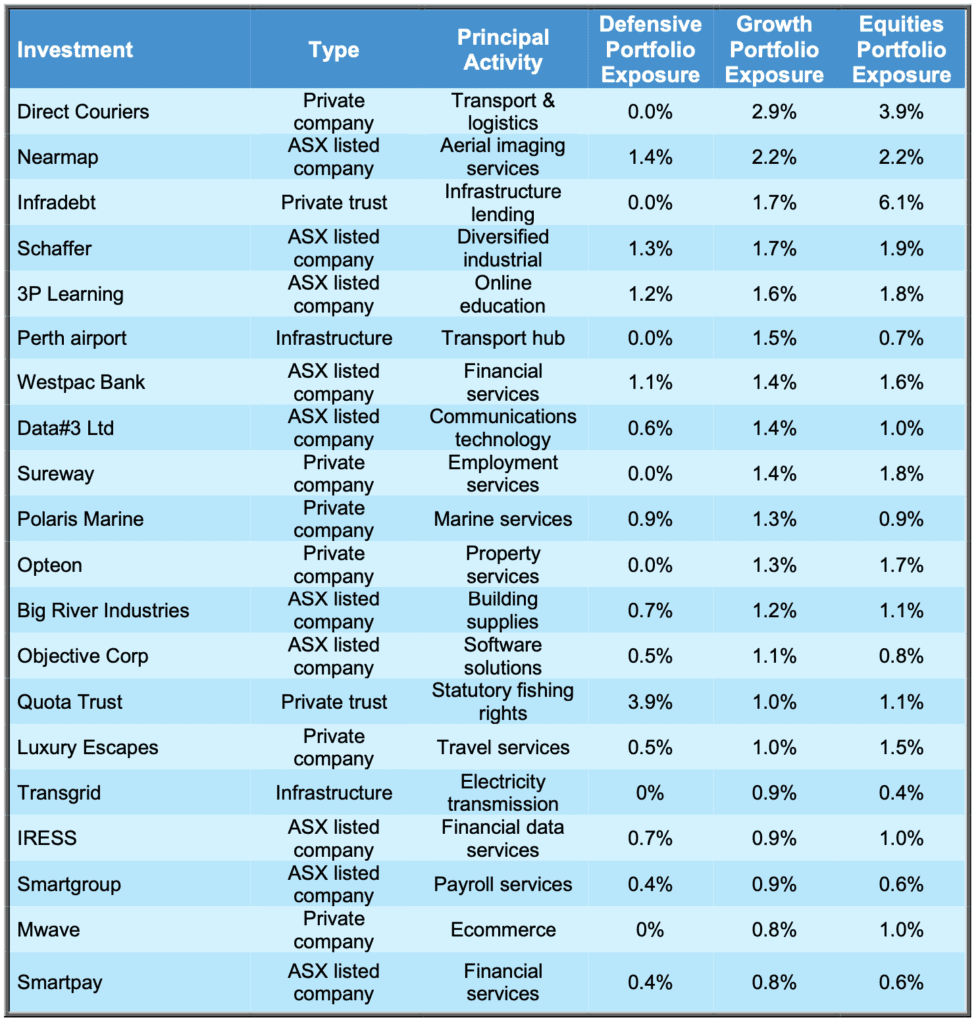

Perhaps a closer look at some of the major holdings (see table right at the bottom) might be instructive.

Direct Couriers – Covid has not been unkind to the courier industry. Direct Couriers is experiencing very strong demand for its services – if there is a hitch it is with availability of labour. An additional investment was made into the business during the year, and it returned in excess of 30% in 2021.

Nearmap – A long term holding, Nearmap’s business is aerial imagery, like Google Earth on steroids. It has consistently grown its contracted revenue base and market share here and now in the US, has the best product in its market, yet suffered share price weakness over the year, falling some 30%. Go figure (??). This is seen as an opportunity, and the Fund has increased its exposure over the past year.

Schaffer – Another long term holding, this conservatively managed company with a diverse asset base had a strong year and, inclusive of two fully franked dividends, returned approx. 25% for the year.

3P Learning – An innovative provider of eductional learning materials delivered online, 3PL returned approx. 35% for the year.

Luxury Escapes – Alert readers will note a new name on the list. Luxury Escapes is the leading online travel agency business. The opportunity arose to invest as the company is seeking expansion capital. Combined with what may well be a strong turnaround story as the tourism sector emerges from its dark days, we’ll watch this one with keen interest.

So, as is often the case, it’s a mixed bag, but with more good news than bad.

It seems I did put the mozz on the Long Term Income Builder option last quarter (slow learner!), as it fell in value for the quarter after a stellar run. Note though that its December distribution is around 2.5%, likely to be fully franked, which suggests that the rebound in dividend receipts is happening as expected. And as dividend income is the main event with this portfolio, that’s a very welcome outcome.

In the “What’s Next?” department, there is no change from our previous update. Over the past six months we have taken some profits off the table, and “de-risked” the diversified portfolios, by:

- Increasing the allocation to defensive investments, and

- Putting some active hedging in place, such as the US Strong Bear Fund, which is specifically designed to profit if the US market falls (and vice versa!)

The facts of life are that such measures, which are designed to reduce volatility and increase protection against adverse market movements, will conversely act as a drag on returns – or rather, an opportunity cost – if markets continue to grow strongly. I guess that’s how it is with insurance – you pay the premium hoping you never have to collect. But if and when you do, having that insurance in place suddenly seems like a really good idea.

On the subject of distributions….

Some investors have queried the variability of quarterly income distributions, and in fact why in some quarters there have been no distributions at all. We hope this explanation will provide some clarity.

We generally pay distributions as and when distributable income is received from the underlying investments. “Distributable income” is made up of two main components:

- Investment income – dividends from the equities funds, interest from bank accounts and interest-bearing deposits;

- Realised capital gains – when managers sell something at a profit (eg Cobram Estate, Yumi’s) or when ARA sells out of a fund and realises the gain.

Re: Item 1:

- The listed equities funds (Sterling, Wattle Fund, River Capital) generally only distribute once a year, at the end of June.

- The private equity funds distribute as and when their investee companies pay dividends, or are sold. This is somewhat spasmodic and hard to predict.

- We are still receiving a good flow of income from TDs and annuities although it is gradually declining as individual contracts mature. Most contracts pay annually on their anniversary date, and so cash receipts are scattered throughout the year.

Re: Item 2:

- Realised gains can be offset against realised losses if you have them, and the recent exit from Proserpine Diversified Trust means there now some tax losses carried forward in the fund. Gains are realised from time to time – and in fact we had a big gain with the sale of Cobram Estate in the September quarter. But the realised losses mean we won’t be distributing these gains for some time – they will be retained in the fund and re-invested.

So the upshot is:

- The income component is tending to reduce because of falling interest rates, and the lumpy nature of actual cash receipts means that while June is usually a big quarter, other quarters are inclined to vary somewhat.

- Capital gains won’t have to be distributed for quite some time. They will remain in the fund and be re-invested. (The upside is that you won’t have to pay tax on them).

- So it may be that for a while we can expect increasing instances of nil distributions especially in September and March. December you can expect distributions (most likely) and June will be the largest.

- These comments apply to Defensive and Growth. Equities generally won’t distribute except in June. With its expanded portfolio the Long Term Income Builder is now likely to receive dividends in each quarter and therefore investors can expect a quarterly payment.

We trust this is helpful. Don’t hesitate to contact us if you want further clarification.

So, who’s got what?

The table below shows the ARAIF’s investments at the time of writing. Please note, the percentages refer to the proportion of each portfolio allocated to that investment, not its rate of return.

Major Holdings – diversified portfolios

Apart from bank deposits and other interest-bearing accounts, Defensive, Growth and Equities portfolios invest in a range of assets through the fund managers listed in the table above. If we drill through to the assets selected and overseen by those managers, there are in fact over a hundred individual securities providing diversification of risk and exposure to a wide range of opportunities.

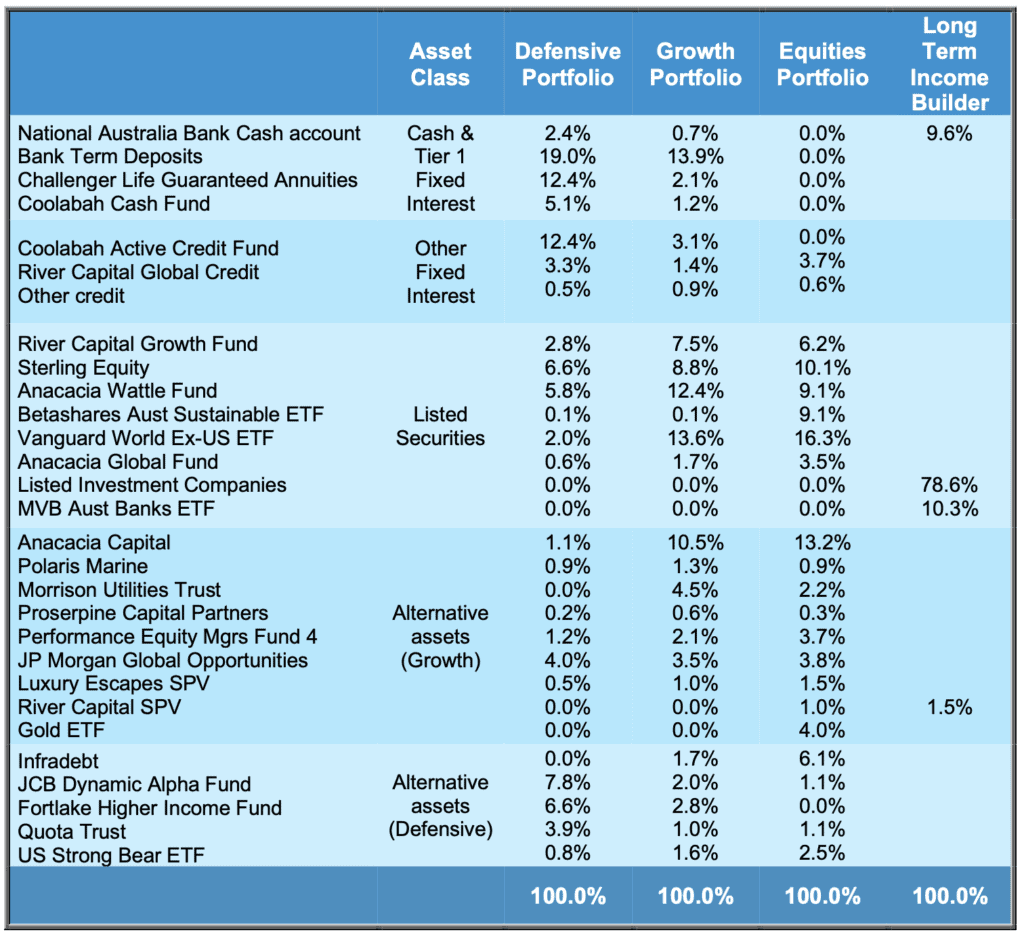

The table below shows the 20 largest individual holdings and what proportion of each portfolio they represent. These are the investments that will have the biggest impact on the portfolios’ returns.

This document has been issued by ARA Consultants Limited for its own use and the use of its clients. Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (Fundhost) is the issuer of the ARA Investment Fund (ARSN:104 232 448). Information contained in this document is general information and is not intended to constitute nor does it purport to offer any specific or individual investment advice. Whilst every effort has been made to ensure the accuracy of the information contained in this document, neither ARA nor Fundhost accept any liability in relation to anyone who makes and acts upon a decision based upon that information. No person should make a decision based upon the information contained in this document without first seeking and obtaining the appropriate professional advice relevant to their own individual circumstances and financial needs. You should consider the Product Disclosure Statement in deciding whether to acquire, or continue to hold the product. You should also refer to the relevant Target Market Determination (TMD) for the product. The PDS and applicable TMDs are available at www.araconsultants.com.au or by contacting ARA by phone on (03) 9853 1688 or by email at info@araconsultants.com.au. We also caution that past returns are just that, and the fact that they have been achieved does not guarantee they will be achieved again.

If you would like a pdf version of this update for your files you can download it here: January 2022 Investment Update.